Subscribe!

PASSING ON WEALTH TO HEIRS

By Kaufman Accounting |

Giving away assets during your life time can help reduce ...

Read More REMINDER: IRS DEADLINE POSTPONED TO JULY 15 FOR THOSE WHO PAY ESTIMATED TAXES

By Kaufman Accounting |

The Internal Revenue Service reminds taxpayers that estimated tax payments for ...

Read More IRS WARNS AGAINST COVID-19 FRAUD

By Kaufman Accounting |

The Internal Revenue Service (IRS) continues to remind taxpayers to guard against ...

Read More WHO QUALIFIES A TAXPAYER FOR THE CHILD AND DEPENDENT CARE CREDIT?

By Kaufman Accounting |

Childcare or adult dependent care can be a major expense. ...

Read More IS IT REALLY THE IRS CALLING?

By Kaufman Accounting |

Crooks impersonating the IRS either by phone, email or in ...

Read More ECONOMIC IMPACT PAYMENTS INFORMATION

By Kaufman Accounting |

The IRS has reported that millions of Americans have already received their ...

Read More WHERE’S MY REFUND?

By Kaufman Accounting |

The IRS issues more than 9 out of 10 refunds ...

Read More WHAT ABOUT MY RETIREMENT ACCOUNT?

By Kaufman Accounting |

Section 2202 of the Coronavirus Aid, Relief, and Economic Security ...

Read More BANK HAPOALIM TO PAY IRS $874-MILLION

By Kaufman Accounting |

According to Law 360’s April 30, 2020 article, Israel’s largest bank, Bank ...

Read More ADDITIONAL FUNDING ANNOUNCED

By Kaufman Accounting |

On April 27, 2020 the Small Business Association (SBA) will ...

Read More AM I ELIGIBLE FOR THE STIMULUS PAYMENT IF I AM LIVING ABROAD?

By Kaufman Accounting |

With clients around the world, we have had many questions ...

Read More PEOPLE FIRST INITIATIVE

By Kaufman Accounting |

To help taxpayers facing challenges due to COVID-19, the Internal ...

Read More BE AWARE OF SCAMS

By Kaufman Accounting |

While the tax filing deadline may have been extended, scammers ...

Read More ISRAEL’S BANK HAPOALIM OFFERS TO SETTLE WITH U.S

By Kaufman Accounting |

On March 23, 2020 taxnotes.com reported that Israel’s largest financial institution, Bank ...

Read More NON-RESIDENT ALIEN TAX RETURN

By Kaufman Accounting |

If you are not a citizen of the US, specific ...

Read More FOREIGN BANK AND FINANCIAL ACCOUNTING REPORTING (FBAR)

By Kaufman Accounting |

The Bank Secrecy Act of 1970 equipped the U.S. Treasury ...

Read More FOREIGN ACCOUNT TAX COMPLIANCE ACT – FATCA

By Kaufman Accounting |

The Foreign Account Tax Compliance Act (FATCA), enacted in 2010, ...

Read More MECHANISMS FOR RELIEF OF DOUBLE TAXATION

By Kaufman Accounting |

Double taxation is defined as the levying of tax by ...

Read More US TAXATION OF NONRESIDENTS

By Kaufman Accounting |

The United States has one of the most complex tax ...

Read More GLOBAL INTANGIBLE LOW-TAXED INCOME INCLUSION (“GILTI”)

By Kaufman Accounting |

The Tax Cuts and Jobs Act of 2017 ("TCJA") brought ...

Read More PASSIVE FOREIGN INVESTMENT COMPANIES (“PFICS”)

By Kaufman Accounting |

United States citizens and tax residents are discouraged from investing ...

Read More LAST MINUTE TAX EXTENDERS

By Kaufman Accounting |

Many of the tax provisions below were set to expire ...

Read More FOREIGN INVESTMENT IN REAL PROPERTY TAX ACT OF 1980 RULES (“FIRPTA”)

By Kaufman Accounting |

The United States has one of the most active real ...

Read More AVOIDING IDENTITY THEFT

By Kaufman Accounting |

Earlier this week the IRS launched Identity Theft Central. This ...

Read More TOP 10 THINGS FILERS NEED TO KNOW ABOUT THE FOREIGN BANK ACCOUNT REPORTING (FBAR)

By Kaufman Accounting |

1. Nonresident filers do not need to file Only filers ...

Read More TOP 5 THINGS US CITIZENS HOLDING FOREIGN COMPANIES NEED TO BE AWARE OF

By Kaufman Accounting |

1. Foreign entity reporting Depending on the type of entity (trust, ...

Read More TOP 10 THINGS EXPATS RESIDING OUTSIDE THE U.S. NEED TO KNOW

By Kaufman Accounting |

1. Expats still have to file in the US The US tax ...

Read More Gig Economy tips taxpayers should remember

By Kaufman Accounting |

The gig economy, also called the sharing or access economy, ...

Read More Major Changes to Retirement Plans Due to COVID-19

By Kaufman Accounting |

In the recent update, the IRS reminds Qualified individuals affected ...

Read More Where’s My Refund?

By Kaufman Accounting |

The IRS reminds taxpayers that one of the best ways ...

Read More Don’t Forget, Social Security benefits may be taxable

By Kaufman Accounting |

The IRS reminds taxpayers receiving Social Security benefits that they ...

Read More A letter from the IRS? What taxpayers need to know if they receive a notice from the IRS

By Kaufman Accounting |

According to the Internal Revenue Service (IRS), they mail letter ...

Read More Paycheck Protection Program Loan Forgiveness

By Kaufman Accounting |

The Paycheck Protection Program (PPP) is a loan designed to ...

Read More Home Office deduction: What taxpayers need to know

By Kaufman Accounting |

The home office deduction allows qualifying taxpayers to deduct certain home ...

Read More Earning a side income: Is it a hobby or a business?

By Kaufman Accounting |

Whether it’s something you’ve been doing for years or something ...

Read More Terms to help taxpayers better understand Individual Retirement Arrangements

By Kaufman Accounting |

IRA, Roth IRA, Simple IRA, Contribution, Distribution – when considering ...

Read More Have tax withheld from unemployment now to avoid a tax-time surprise later

By Kaufman Accounting |

2020 has been a unique year that has brought many ...

Read More Check tax withholdings now as the last quarter of 2020 begins

By Kaufman Accounting |

With the last quarter of 2020 just beginning, the IRS ...

Read More Six tips for people starting a new business

By Kaufman Accounting |

Understanding the tax responsibilities that come with starting a business ...

Read More Security Summit partners warn taxpayers of new COVID-related text scam

By Kaufman Accounting |

The Internal Revenue Service, state tax agencies and the tax ...

Read More How the CARES Act changes deducting charitable contributions

By Kaufman Accounting |

Whether taxpayers are supporting natural disaster recovery, COVID-19 pandemic aid ...

Read More Extended Federal Filling and Payment Deadlines

By Kaufman Accounting |

On March 17, 2021, the Treasury Department and Internal Revenue ...

Read More Third Round of Economic Impact Payments

By Kaufman Accounting |

With the recent approval of the American Rescue Plan Act, ...

Read More Are cryptocurrency purchases made in USD reportable to the IRS?

By Kaufman Accounting |

Many taxpayers have noticed a new question Form 1040 asking ...

Read More Where’s my third economic impact payment?

By Kaufman Accounting |

The third round of economic impact payments are being sent ...

Read More Tips to Help You Figure Out if Your Gift is Taxable

By Kaufman Accounting |

If you've given money or property to someone as a ...

Read More What records do I need to maintain regarding my transactions in virtual currency?

By Kaufman Accounting |

Record keeping is an important part of any investment transaction. ...

Read More IRS Struggled to Answer Calls in the 2021 Tax Season

By Kaufman Accounting |

A recent article from Law 360 Tax Authority noted that ...

Read More The IRS is Hiring Thousands of New Tax Auditors

By Kaufman Accounting |

The Internal Revenue Service is hiring thousands of new auditors ...

Read More IRS announces two new online tools to help families manage Child Tax Credit payments

By Kaufman Accounting |

The American Rescue plan increased the maximum Child Tax Credit ...

Read More Cost Basis in Virtual Currency

By Kaufman Accounting |

Much like other investments, knowing the cost basis of your ...

Read More IRS Reminder: Tax Scams continue year-round

By Kaufman Accounting |

Although the April filing deadline has passed scam artists remain ...

Read More Things people do during the summer that might affect their tax return next year

By Kaufman Accounting |

It's summertime and for many people, summertime means change. Whether ...

Read More Buying and Selling with Virtual Currency

By Kaufman Accounting |

There are many services that can now be paid for ...

Read More Financial safety: The often-forgotten piece of disaster preparedness

By Kaufman Accounting |

After a natural disaster, having access to personal financial, insurance, ...

Read More Homeownership and taxes: Things taxpayers should consider when selling a house

By Kaufman Accounting |

It’s important for taxpayers to understand how selling their home ...

Read More Cost of home testing for COVID-19 is eligible medical expense; reimbursable under FSAs, HSAs

By Kaufman Accounting |

The Internal Revenue Service reminds taxpayers today that the cost ...

Read More Retirement and taxes: Understanding IRAs

By Kaufman Accounting |

Individual Retirement Arrangements, or IRAs, provide tax incentives for people ...

Read More Understanding the tax responsibilities that come with starting a business

By Kaufman Accounting |

Small business owners have a variety of tax responsibilities. Understanding ...

Read More Choosing and Identifying Cost Basis when units of Virtual Currency are sold

By Kaufman Accounting |

Individuals often own multiple kinds of virtual currency at the ...

Read More Easy steps taxpayers can take now to make tax filing easier in 2022

By Kaufman Accounting |

Organized tax records can help ensure that the tax preparation ...

Read More IRS Reminds families to make online safety a priority

By Kaufman Accounting |

The Internal Revenue Service (IRS) reminds families, teens and senior ...

Read More Gifting and Donating virtual currency

By Kaufman Accounting |

It is the season of giving, but what happens if ...

Read More Important mailings to watch for

By Kaufman Accounting |

Taxpayers to who received either the Advanced Child Tax Credit ...

Read More Taxpayers beware: Tax season is prime time for phone scams

By Kaufman Accounting |

The IRS reminds taxpayers to be aware that criminals continue ...

Read More Reasons why some tax refunds filed electronically take longer than 21 days

By Kaufman Accounting |

Even though the Internal Revenue Service issues most refunds in ...

Read More Money received through ‘crowdfunding’ may be taxable

By Kaufman Accounting |

With the increasing popularity of crowdfunding, the IRS reminds taxpayers ...

Read More What taxpayers should do if they get an identity theft letter from the IRS

By Kaufman Accounting |

With identity theft on the rise, the IRS wants taxpayers ...

Read More What is virtual currency?

By Kaufman Accounting |

The IRS explains that virtual currency is treated as property ...

Read More School is out for summer, but tax planning is year round

By Kaufman Accounting |

Now that the April filing deadline has passed, most people ...

Read More Preparing for a Natural Disaster

By Kaufman Accounting |

In 2021, the Federal Emergency Management Agency (FEMA) declared major ...

Read More Accepting virtual currency as payment

By Kaufman Accounting |

As virtual currency gains acceptance, more people are paying for ...

Read More When the lemonade stand makes bank: Young entrepreneurs and taxes

By Kaufman Accounting |

Teens and young adults often go into business for themselves ...

Read More Scammers use every trick in their communication arsenal to steal your identity, personal financial information, money and more

By Kaufman Accounting |

The Internal Revenue Service recently noted the 5th item on ...

Read More Determining basis when you have been paid in virtual currency

By Kaufman Accounting |

If you have been paid for services in virtual currency, ...

Read More People should know if their pastime is a hobby or a business

By Kaufman Accounting |

From collecting stamps and woodworking to crafting and quilting, people ...

Read More IRA’s are one tool in the retirement planning toolbox

By Kaufman Accounting |

There are many ways people plan for retirement. Individual Retirement Arrangements, ...

Read More Virtual Currency Trades and Forks

By Kaufman Accounting |

The IRS has compiled a list of several Frequently Asked ...

Read More What you need to know if you are donating virtual currency

By Kaufman Accounting |

As we head into the last few months of the ...

Read More Some things to know about crowdfunding and taxes

By Kaufman Accounting |

Crowdfunding is a popular way to raise money online. People ...

Read More Understanding how the IRS contacts taxpayers; Avoiding scams and how to know it’s really the IRS reaching out

By Kaufman Accounting |

With continuing phone and in-person scams taking place across the ...

Read More Cyber Security Awareness

By Kaufman Accounting |

Cybersecurity Awareness Month, conducted every October, is a collaboration between ...

Read More 401(k) limit increases to $22,500 for 2023, IRA limit rises to $6,500

By Kaufman Accounting |

The Internal Revenue Service announced recently that the amount individuals ...

Read More Choosing and Identifying Cost Basis when units of Virtual Currency are sold

By Kaufman Accounting |

Often, these units are acquired at different times with different ...

Read More Taxpayers should hang up if tax season scammers come calling

By Kaufman Accounting |

The tax filing season is a popular time for scammers ...

Read More Tax tips for gig economy entrepreneurs and workers

By Kaufman Accounting |

In recent years, the gig economy has changed how people ...

Read More What records do I need to maintain regarding my transactions in Virtual Currency?

By Kaufman Accounting |

Record keeping is an important part of any investment transaction. ...

Read More Taxpayers should learn about these common tax scams

By Kaufman Accounting |

While scammers work hard during tax season to try to ...

Read More Proposed regulations related to the new clean vehicle critical mineral and battery components go into effect April 18

By Kaufman Accounting |

The Internal Revenue Service published proposed regulations recently in the ...

Read More IRS Proposes New Guidance Around NFT Classification That Would Increase Taxes

By Kaufman Accounting |

As reported by Blockworks in their March 23, 2023 publication, ...

Read More IRS offers tips on preparedness and how to protect personal information during natural disasters

By Kaufman Accounting |

So far in 2023, the Federal Emergency Management Agency (FEMA) ...

Read More Hobby or business: here’s what to know about that side hustle

By Kaufman Accounting |

Sometimes the line between having a hobby and running a ...

Read More Determining basis when you have been paid in virtual currency

By Kaufman Accounting |

If you have been paid for services in virtual currency, ...

Read More Tax considerations when selling a home

By Kaufman Accounting |

Many people move during the summer. Taxpayers who are selling ...

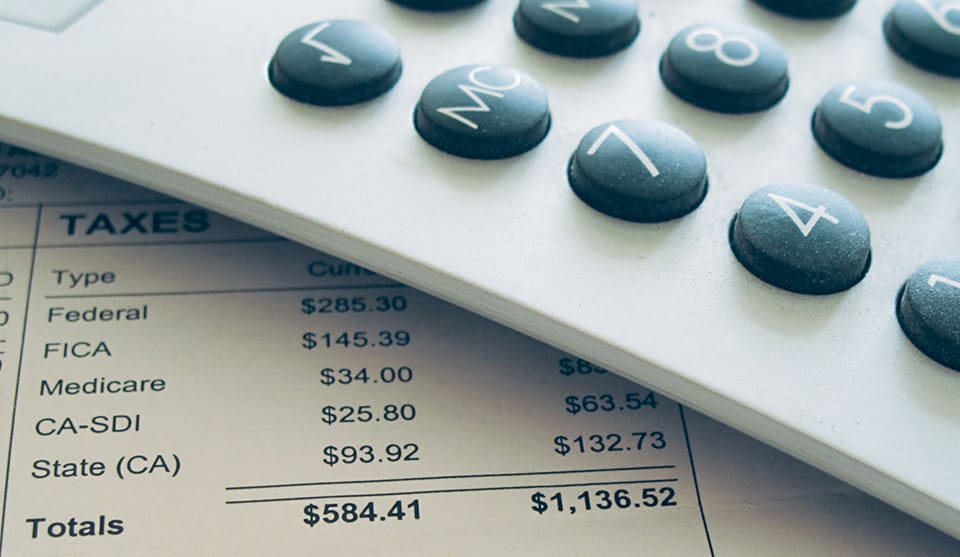

Read More What employees need to know about income tax withholding

By Kaufman Accounting |

Whether someone is entering the workforce for the first time ...

Read More Digital Assets

By Kaufman Accounting |

Digital assets are broadly defined as any digital representation of ...

Read More Summertime activities that might affect people’s tax return next year

By Kaufman Accounting |

For many people, summertime means change. Whether it's a life ...

Read More Tax to-dos for newlyweds to keep in mind

By Kaufman Accounting |

Anyone saying "I do" this summer should review a few ...

Read More What is virtual currency?

By Kaufman Accounting |

The IRS explains that virtual currency is treated as property ...

Read More Tax tips for new parents

By Kaufman Accounting |

Kids are expensive. Whether someone just brought a bundle of ...

Read More Business travelers should check out these deductions before hitting the road

By Kaufman Accounting |

Many people travel for their job - some for an ...

Read More Buying and Selling with Virtual Currency

By Kaufman Accounting |

There are many services that can now be paid for ...

Read More Cyber Security Awareness

By Kaufman Accounting |

Cybersecurity Awareness Month, conducted every October, is a collaboration between ...

Read More Individual retirement accounts can be important tools in retirement planning

By Kaufman Accounting |

It is never too early to begin planning for retirement. Individual ...

Read More Tips to help taxpayers make sure their donations go to legitimate charities

By Kaufman Accounting |

When disaster strikes, Americans can always be counted on to ...

Read More Debunking common myths about federal tax refunds

By Kaufman Accounting |

Once people complete and file their tax return, many of ...

Read More Taxpayers and tax pros: Beware of these common tax scams

By Kaufman Accounting |

Taxpayers and tax professionals should remain alert and aware of ...

Read More What records do I need to maintain regarding my transactions in virtual currency?

By Kaufman Accounting |

Record keeping is an important part of any investment transaction. ...

Read More Newlyweds tax checklist

By Kaufman Accounting |

Summer wedding season has arrived, and newlyweds can make their ...

Read More Hobby or business: What people need to know if they have a side hustle

By Kaufman Accounting |

Hobbies and businesses are treated differently when it comes to ...

Read More Taxpayers should report digital asset transactions, gig economy income, foreign source income and assets

By Kaufman Accounting |

The Internal Revenue Service reminds taxpayers they’re generally required to ...

Read More Energy efficient home improvements could help people reduce energy bills and taxes

By Kaufman Accounting |

Homeowners who make improvements like replacing old doors and windows, ...

Read More Disaster tax relief information and resources on IRS.gov

By Kaufman Accounting |

IRS.gov has information disaster victims may need, including information about ...

Read More Determining basis when you have been paid in virtual currency

By Kaufman Accounting |

If you have been paid for services in virtual currency, ...

Read More What taxpayers should do if they get an identity theft letter from the IRS

By Kaufman Accounting |

With identity theft on the rise, the IRS wants taxpayers to understand ...

Read More Employer-offered educational assistance programs can help pay for college

By Kaufman Accounting |

An educational assistance program is an employer’s written plan to provide ...

Read More Cybersecurity Awareness

By Kaufman Accounting |

Cybersecurity Awareness Month, conducted every October, is a collaboration between ...

Read More Changes coming to the 2024 tax rules

By Kaufman Accounting |

For tax year 2024, participants who have self-only coverage in ...

Read More Tax benefits for businesses that accommodate people with disabilities

By Kaufman Accounting |

Businesses that make structural adaptations or other accommodations for employees ...

Read More Digital assets

By Kaufman Accounting |

You may have to report transactions with digital assets such ...

Read More Gifting and Donating Virtual Currency

By Kaufman Accounting |

It is the season of giving, but what happens if ...

Read More What people need to know when starting a business

By Kaufman Accounting |

The IRS knows that understanding and meeting tax obligations is ...

Read More Credits for new clean vehicles purchased in 2023 or after

By Kaufman Accounting |

If you placed in service a new plug-in electric vehicle ...

Read More Get ready for tax filing season 2025

By Kaufman Accounting |

As tax filing season approaches, the IRS Get Ready campaign ...

Read More How taxpayers can protect themselves from gift card scams

By Kaufman Accounting |

Taxpayers should be aware of gift card scams and take ...

Read More What is virtual currency?

By Kaufman Accounting |

The IRS explains that virtual currency is treated as property ...

Read More Access retirement funds in a disaster

By Kaufman Accounting |

The SECURE 2.0 Act makes it easier for qualified individuals ...

Read More Essential tax tips for marriage status changes

By Kaufman Accounting |

A taxpayer’s filing status generally depends on their being married or unmarried ...

Read More Buying and Selling with Virtual Currency

By Kaufman Accounting |

There are many services that can now be paid for ...

Read More Record Keeping Requirements for Charitable Contributions

By Kaufman Accounting |

Reporting Requirement Thresholds: $501 or greater amount. Cash. Do not ...

Read More Estimated Taxes

By Kaufman Accounting |

The federal income tax is a pay-as-you-go tax. You must ...

Read More What records do I need to maintain regarding my transactions in virtual currency?

By Kaufman Accounting |

Record keeping is an important part of any investment transaction. ...

Read More