U.S. International Tax Services

U.S. International Taxes

Those living abroad, foreign individuals with assets in the US, expatriates, and non-residents have complex tax needs that require the assistance of a skilled professional. At Kaufman Accounting, our expertise is in U.S. international tax services.

Contact our U.S. international tax firm for more information on how we can help you file a non-resident or resident alien tax return, or improve compliance on reporting international income and financial accounts.

Tax Services for Citizens, Resident Aliens, and Non-Residents

Whether you are a U.S. citizen temporarily residing abroad, a resident alien living in the U.S., or a non-resident alien for tax purposes, you may owe taxes to the United States.

The U.S. is one of the few countries in the world that tax based on citizenship rather than residency so despite living overseas for many years, U.S. citizens will ALWAYS have to file tax returns. For those persons who hold citizenship in another country but are residing in the U.S. as resident aliens, they are subject to the requirement of filing the same returns as citizens until their status changes. Lastly, even for non-residents who do not live in the U.S., they may be subject to filing returns to report income that is sourced to the U.S.

For information on help, filing forms 2555, 1116, and 1040NR visit our pages on tax filing for US citizens and non-resident tax services.

Tax Filing for Foreign Companies

We help our clients file all forms related to offshore business interests, particularly companies abroad in which our clients hold a percentage interest. Even though your business is based in another country, there may be some reporting requirements here in the United States. These requirements are applicable to clients who are partners in a foreign partnership, shareholders in a foreign corporation, sole owners of foreign single-member entities, as well as directors or officers of overseas companies.

The Tax Cuts and Jobs Act put in place some major changes recently with how foreign profits are taxed in the U.S., particularly with regards to foreign corporations. Under the old law, the recognition of income earned by a foreign corporation was not required by U.S. shareholders until that income was distributed in the form of a dividend. In an effort to reduce the incentive to shift corporate profits out of the U.S. and defer income recognition, the Tax Cuts and Jobs Act introduced a new category of income called GILTI or “Global Intangible Low Tax Income.” In effect, this new category introduces a tax on a foreign corporation’s active income.

Allow us to navigate and help you understand all the new requirements created by the most recent tax reform. Get experienced assistance in filing Form 5471 (Information Return of U.S. Persons with Respect to Foreign Corporations), Form 8865 (Return of U.S. Persons with Respect to Certain Foreign Partnerships), and Form 8858 (Information Return of U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches) by contacting our firm.

Ready to Leave the US? Ask about Expatriate Tax Processes

Choosing a new country as your permanent home and renouncing your US citizenship or green card is a task that requires careful financial consideration. We help you calculate the tax implication, settle any outstanding debts with the IRS and ensure complete and accurate tax compliance with respect to the exit tax rules. Our international tax firm also helps you make sense of the many forms and laws that require your attention before you can depart.

Learn more about the expatriation process and how it affects your tax plan by visiting our page on expatriation services.

FATCA Compliance

Don’t get caught in the IRS’ cross-hairs if you have foreign assets that provided you with income, but you have failed to report them. We can help you improve your standing with the IRS by disclosing pertinent tax information about offshore assets and accounts through specific programs. Get ahead of tax problems or start now to resolve potentially risky tax choices.

Visit our page for more information on Streamlined Filing Procedure and Delinquent FBAR Submissions. We can also work with clients to file form 8938, also known as the FATCA Statement of Specified Foreign Financial Assets.

Comprehensive International Tax Services

We encourage you to browse our website to learn more about what we can do to create a tax plan that resolves your concerns and meets your financial goals. Our international tax accountant is committed to serving your needs.

Although our office is based in McLean, VA we serve clients across the United States and abroad.

Non-Resident Taxes

If you earn income in the US, you have to pay taxes. This rule applies to individuals of differing citizenship statuses, including non-resident aliens.

If you’re looking for help in non-resident alien tax returns, our firm is equipped to help. We are knowledgeable in tax preparation for clients in unique circumstances. Ask us how we can make tax filing easier for non-residents.

Do I Need to File a Non-Resident Alien Tax Return?

Before you worry whether you’re filing your taxes correctly, consider if you are eligible to file a non-resident alien tax return in the first place. Please note that the circumstances below apply only to those individuals who do not have a green card or hold a worker visa:

- Business Ownership

-

Receiving Income from an Entity in the US

-

Responsible for a Trust or Estate in the US

-

Received rental income from US real estate

If any of the above apply to your particular circumstances, you must pay taxes in the US. Even if you did not receive income from your US-based business, you are still required to file applicable forms. If you have questions about what to file and when, our firm and tax professionals can help.

Compliance and Consulting for Non-Resident Taxes

Making sure you’re using the right forms and submitting information on time is an important part of avoiding complications and maximizing credits for any taxpayers -- especially those with special considerations, including those with non-resident alien status. Kaufman Accounting helps foreign individuals make sense of their tax return and understand what they are expected to pay to the IRS using forms 1040NR and 1040NR-EZ.

We take all opportunities to minimize liability and maximize credits. In some cases, treaties between your country of origin and the US dictate the percentage at which you may be taxed. In other cases, you may be eligible for business credits that lower tax amounts. Our goal is making sure non-resident aliens are compliant with all tax laws that dictate how much and when they should pay the federal government.

Ask our firm about Filing your Non-Resident Alien Tax Return!

If you’re ready to leave the US, our firm helps you file required forms that indicate you are up-to-date with all tax matters. This documentation must be submitted to the IRS prior to your departure to avoid any complications.

If you’re a foreign individual currently residing in the US, or earn income from US sources, don’t wait to seek help for your tax needs. The sooner you start planning to file required documentation, the better your chances for remaining compliant with applicable regulations.

Contact Kaufman Accounting today for more information about non-resident alien tax help.

Streamlined Offshore Procedure

Recently, the IRS relaxed the requirements for compliance and significantly reduced the penalty for eligible taxpayers who non-willfully failed to disclose otherwise reportable foreign financial account(s)/asset(s) and gross income derived therefrom. The relevant disclosure forms involved include FinCEN Form 114 (previously Form TD F 90-22.1 (FBAR)), as well as various other international information returns.

Prior to the IRS's recent announcement, taxpayers faced a penalty of up to 27.5% of the highest aggregate balance/value of the taxpayer's undisclosed foreign financial assets pursuant to the draconian terms of the Offshore Voluntary Disclosure Program (OVDP).

Under the new so-called Streamlined Offshore Procedure, eligible persons are now subject to a reduced either 0% or 5% penalty (instead of 27.5%), depending on whether the specific person meets a specialized residency test.

Taxpayers who wish to take advantage of the newly relaxed Streamlined Offshore Procedures will be required to, among other things, (i) file amended tax returns for 3 years, (ii) file information return for 6 years, and (iii) certify under penalties of perjury that the prior failure to report all income, pay all tax, and file all required information returns, including FBARs was due to non-willful conduct.

Per the IRS, these new procedures will be available for an indefinite period of time until otherwise announced. Now is a good opportunity to take advantage of the reduced penalty structure before the IRS decides to close or modify the program.

The IRS and the Department of Justice offshore enforcement efforts continue to raise the risk of detection of taxpayers with undisclosed foreign accounts and assets for the foreseeable future; Please contact us so we can determine eligibility under the new Streamlined Offshore Procedure.

Delinquent FBAR Submission

Taxpayers who do not need to use the Streamlined Filing Compliance Procedures to file delinquent or amended tax returns to report and pay additional tax, but who have not filed a required Report of Foreign Bank and Financial Accounts (FBAR) (FinCEN Form 114, previously Form TD F 90-22.1), are not under a civil examination or a criminal investigation by the IRS, and have not already been contacted by the IRS about the delinquent FBARs should file the delinquent FBARs according to the FBAR instructions.

Kaufman Accounting is experienced in helping taxpayers take the appropriate steps to resolve delinquent FBARs.

The IRS will not impose a penalty for the failure to file the delinquent FBARs if you properly reported on your U.S. tax returns and paid all tax on the income from the foreign financial accounts reported on the delinquent FBARs and you have not previously been contacted regarding an income tax examination or a request for delinquent returns for the years for which the delinquent FBARs are submitted.

Contact us today to discuss your FBAR filing needs!

Expatriation Services

Expatriation from the US is a process that many individuals choose to complete due to jobs, quality of life, or even tax and political reasons. As a significant life decision, expatriation requires the skilled assistance of financial and legal professionals. At Kaufman Accounting, we provide expatriation services in to help you make sense of the financial implications involved in leaving the US for another country.

If you’re ready to move on to the next step in the expatriation process, contact our tax and accounting firm for your consultation.

Defining your Tax Needs: Temporary or Permanent Relocation

Kaufman Accounting works with both US citizens living abroad and current citizens looking to renounce their status and permanently relocate to another country. If you’re temporarily relocating outside the US for work, whether for a few months or years, we help you determine appropriate taxes and file forms on-time. Please visit our page on tax compliance for residents living abroad for more information about this service.

If your goal is to leave the US permanently, we are here to guide you on the tax and legal parts of your journey, which are often the most complicated.

Expatriation: Helping Clients Leave the US Permanently

Renouncing your citizenship involves working with the IRS and having specialized legal advice ready when you need it. Our firm has years of tax experience and works in close conjunction with a US tax attorney to provide expatriation services in McLean. This process includes:

Reconciling Accounts with the IRS - You will not be a candidate for expatriation if you are currently dealing with tax problems from the last five years. In order to expatriate, you should be completely paid-up with the federal tax giant. In the event that you are dealing with back taxes and penalties, contact our firm for more information on how we can help you solve these issues before moving forward in the expatriation process.

Calculating Exit and Gift Taxes - Before you become a former citizen, you may be eligible to pay a fee or exit tax, which is a percentage of income. This is usually applicable for high-net-worth individuals and is based on assets and income tests. The US also imposes hefty gift and estate taxes on assets left behind for loved ones.

Preparation of Forms - Paperwork is a key part of the expatriation process. Our firm ensures that all required documents are filled out accurately and filed, as you move closer to your goal of permanent relocation outside the US. We file form 8854, or Initial and Annual Expatriation Statements on behalf of our clients.

Our goal is to make sure clients are compliant with all legal and tax regulations pertaining to renouncing their citizenship, including consideration of capital gains taxes and the minimization of gift taxes. While leaving the US permanently is a complex process, our firm is here to make it easier on you and reduce liability wherever applicable.

Know the Cost of Expatriation - Contact our Firm for your Consultation

The cost of renouncing US citizenship continues to rise and tax regulations can demand more of your income and assets than you’d like to give. With a CPA on your side, you can benefit from the legal minimization of tax liability and knowledgeable guidance on becoming an expat.

Our McLean, VA office delivers services to clients around the world.

Call Kaufman Accounting today at (703) 342-4949 to learn more about how we can help.

US Expats & Nomads Living Abroad

Living and working outside your country of origin comes with a number of complications, not the least of which is how you’ll file taxes. If you are a US citizen or Green Card holder living abroad, you may still be obligated to report your worldwide income and foreign financial assets to the U.S. government on an annual basis. At Kaufman Accounting, our expat tax services are designed to take the confusion out of this complex process, so you don’t have to worry about missing a deadline or failing to report income that is liable for taxation.

US Citizens & Residents Living in Puerto Rico

The Commonwealth of Puerto Rico has its own separate and independent tax system. Although it is modeled after the U.S. Tax System, there are differences.

Taxation

Generally, you will file returns with both Puerto Rico and the United States; unless you are a Puerto Rico bona fide resident and have only income from Puerto Rico sources.

The income reported on your tax return depends on your residency status in Puerto Rico.

Generally, you are a bona fide resident of Puerto Rico if, during the tax year, you:

- Meet the presence test,

- Do not have a tax home outside of Puerto Rico, and

- Do not have a closer connection to the United States or to a foreign country than to Puerto Rico.

What You Should Know About Doing Business in Puerto Rico

- RENT COSTS CAN BE UP TO 75% LESS THAN U.S.

- HEALTH COSTS ARE ABOUT 40% LOWER THAN U.S.

- 10 AIRPORTS AND 3 ARE INTERNATIONAL

- OVER 70 DIRECT FLIGHTS DAILY TO MAJOR U.S. CITIES

- LOCATED ½ WAY BETWEEN NORTH AND SOUTH AMERICA

- TAX RATES AS LOW AS 4%

Key Tax Acts in Puerto Rico

- Act 20 – Export Services

- Act 22 – Individual Investors

- Act 273 – International Financial Centers

- Acts 399 – Insurance Center

- Act 185 – Private equity Funds

- Acts 27 – Film Incentives

- Act 29 – Public Private Partnerships

- Act 73 – Manufacturing Incentives

- Act 82/83 – Renewable Energy Incentives

- EB-5 – Foreign investor Program

Act 20 Export Services

- 4% Income Tax Rate

- 100% Exemption on Distributions of E&P

- 100% Exemption from Real Property taxes

- 100% Exemption from Personal Property Taxes

- 60% Exemption from Municipal Taxes

What Businesses Qualify Under Acts 20

- Research & Development

- Advertising & Public Relations

- Consulting

- Commercial Arts & Graphics Services

- Engineering Services

- Professional Services – Legal and Accounting

- Management Services

- Data Processing Services

- Telecommunications

- Call Centers

- Shared Service Centers

- Storage and Distributions Centers

- Educational Services

- Hospitals and Laboratories

- Investment Banking

- Financial Services

G-4 Visa Holders

Finding a tax preparer with expertise in interpretation, compliance, planning and filing of taxes in accordance with the rules and regulations that are unique to a G-4 visa holder can be difficult. For our clients working with the IMF, UN, IADB or other International organizations, Dale Mason, CPA & Co acts as a consultant to Kaufman Accounting on some G-4 client engagements.

Dale Mason, CPA is an independent tax and financial consultant who works with Kaufman Accounting, PC to provide our international organization clients with the highest quality service.

With over 25 years of experience in international tax consultancy, including almost 20 years with Big 4 global accounting firms such as Arthur Anderson, PWC and KPMG, Dale has practiced tax in California, Central Europe, and in the Washington D.C. Metro Area.

While building and directing Central Europe’s largest expatriate tax practice for PWC, Dale developed a keen understanding of the issues surrounding living abroad and the significant international tax and financial problems that expatriates face.

For the last decade, he has been a highly sought after speaker and a trusted tax advisor to employees, retirees and families from the World Bank, International Monetary Fund, Inter-American Development Bank, and the United Nations. While Dale is passionate about technical tax subject matters, he has a warm and approachable style that invites his audiences and clients to ask practical, relevant questions during his seminars.

Business Services

Business Accounting

At Kaufman Accounting we are your one-stop-shop for business accounting services. Those who have visited our site know that we are well-versed in matters of taxation; however, our financial professionals also excel at comprehensive accounting support and part-time CFO services to grow your small business.

If you’re a small business owner looking for an experienced accountant near you, contact our firm today for a small business accounting consultation.

Monthly Business Bookkeeping

When you fail to reconcile accounts at the end of every month, your books can quickly get out of control. Not many business owners have the time or experience to take care of routine bookkeeping tasks, which is why seeking outsourced accounting help is an important part of success at your venture.

Ask our small business professional about how we can help with the following services:

- General ledger

- Trial balance

- Accounts payable/receivable

- Credit card reconciliation

- Record-keeping and data entry

- Bank reconciliation

- Intercompany account reconciliation

If your books are already a mess, don’t hesitate to call our firm immediately. We work closely with clients to ensure they get the help they need for better business operations and compliance. Organized bookkeeping methods also take the stress out of tax time, by making accurate numbers easy to access.

Payroll Services for Small Businesses

Another time-consuming task at your place of business is paying employees on a routine basis. Small business owners who are used to paying themselves may not be prepared for the growth milestone of filing for, and paying employees.

Keep your employees happy and keep current with payroll tax deposits by outsourcing payroll to Kaufman Accounting. Our team enters hours worked, files tax documents, and can provide your employees with direct deposit or manual checks.

Business Tax Planning and Preparation

If you’re already a business accounting client at our McLean firm, your tax plan is an on-going part of our strategy for your company. But if you’re trying to file business taxes on your own, the process can be challenging.

Our firm helps you find deductions and vital credits you could be missing without help from a business tax accountant. We also make sure to file your paperwork on-time, as something as seemingly insignificant as a missed tax deadline can suddenly put a financial burden on your small business.

Hire a Part-Time CFO for your Small Company

We go beyond regular accounting functions by acting as your company’s part-time CFO. The guidance of a top-level financial professional is often indispensable for business growth, but not many entrepreneurs can afford a CFO’s price tag.

Ask Kaufman Accounting about creating budgets, financial forecasting, succession planning, and working with third-parties and lenders. With affordable, outsourced CFO services, your company gets access to the experienced support it needs.

Our McLean, VA based office delivers services to clients across the US and abroad. We are committed to meeting your business’ needs with comprehensive accounting services. Ask us what we can do for you by scheduling a consultation today!

Payroll Services

There are many parts of running a business that are often best handled by an experienced accountant. When it comes to payroll, our firm can free up business owners’ schedules by taking this concern off of their to-do list.

Ask Kaufman Accounting about payroll help for small businesses!

Small Business Payroll Processing

Our firm acts as a full-service payroll provider for your company. If you have too much to do in running daily business operations, outsource payroll processing to our trusted accountant. We take the stress out of entering hours and ensuring that employees are paid on time. Large companies have entire accounting departments for which payroll is a primary duty, but if you cannot afford this kind of staffing, let our accounting firm provide the support you need.

All it takes is an e-mail to our team with the names of employees and hours worked. Our accountant can take it from there, ensuring income is properly calculated and all taxes are withheld. Your employees are paid in a timely manner, whether they’ve chosen direct deposit or manual check. Payroll is just one of the many time-consuming back-office processes we can take on to ensure efficient company operations.

If you are a new business start-up and looking to optimize back-office tasks with a professional, ask our firm about obtaining an EIN, or Employer Identification Number, establishing a pay period, and determining the rate of compensation. Even if you are the sole proprietor and employee of the company, figuring out the best way to pay yourself is part of making money-smart business decisions.

Payroll Tax and Accounting Services

Part of our responsibility as your outsourced payroll professional is the routine payment of taxes. This can be difficult to juggle by yourself, as taxes must be filed on both a quarterly and annual basis. Payroll calculations can be confusing, even if you’re operating out of popular accounting software. As with any financial process, mistakes can create financial setbacks that any business owner would want to avoid.

In addition to taxes, our firm firm files employee W2s and all other forms required by state and local taxes.

Wondering how to do Payroll for Your Small Business? Ask our firm!

Making decisions on how your payroll is handled is an important part of business operations, especially if you have one of more employees that contribute to your company’s growth and development. Make sure you’re providing them with everything they need to feel confident in your company and to support financial compliance for back-office operations.

Our McLean, VA based firm serves clients across the United States, and abroad. If you have questions about our payroll services, please contact us.

US Tax Preparation for Businesses

Kaufman Accounting is a leading service provider of US tax preparation services for small to medium-sized businesses. With more than 15 years of experience, we are experts in the complex tax issues that business may encounter.

The Internal Revenue Service (IRS) requires that all entities file tax returns annually. Our experienced CPA can help your business to navigate the complex rules of corporate taxation. We can assist your Partnership, Corporation or S-Corporation in the filing of:

- Federal Income Tax Returns

- State Income Tax Returns

- Sales Tax reporting

- Use Tax Returns

Specializing in the unique, cross boarder issues that US entities with foreign subsidiaries and Foreign entities with US subsidiaries face, we can help your business navigate global intangible low-tax income (GILTI) calculations and the reporting needs for US Persons with respect to certain foreign corporations (Form 5471).

Keeping up with business tax forms and filling deadlines can be overwhelming. Missing a deadline can be costly. From startup help, comparison of entity types to tax planning for businesses, Kaufman Accounting can help to find deductions and vital credits to minimize your Federal and State tax liabilities.

Our firm serves business clients across the Unites States and internationally. Learn more about how we can help your business by scheduling a consultation today.

Individual Taxes

For greater client convenience, most of our services can be provided online, with consultations taking place over the phone or through video conference; geography is no longer a factor in finding an accounting professional you can trust.

While many tax preparers will simply intake W2s and 1099s and provide you with a computer-created tax return to sign, Kaufman Accounting goes the extra mile to provide a real discussion about your unique financial situation. We want clients to improve their financial standing with personalized strategies, reduced tax liability, and by taking advantage of savings opportunities.

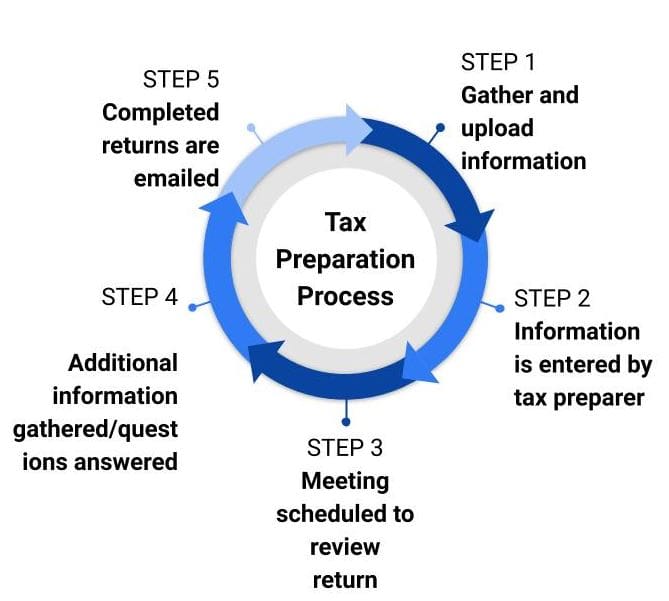

It is our goal to ensure that the tax preparation process is as easy as possible, comprised of 5 simple steps:

Step 1: Gather your tax information and upload your documents, We utilize the Intuit Link system to guide our clients through a custom checklist of questions and documents needed. The Intuit Link system is easy to use (just snap a picture of your document with your cell phone and upload) and it is more secure than email.

Your personal information is safe!

Step 2: One of our tax preparers is assigned to assist in gathering the above information and getting it entered into the tax system.

Step 3: Once your information is entered, a meeting is scheduled and conducted via Skype, Zoom or Google Hangouts. This meeting provides an opportunity for us to go over your return with you, answering any questions you might have along the way.

Step 4: If, after the meeting, there are additional pieces of information or clarifications that are needed, we will let you know.

Step 5: Completed tax returns will be emailed to you with clear and concise filing instructions. Most returns can be electronically filed.

Clients who choose Kaufman Accounting rely on competent advice, dedication, and quick response.

Contact us today to learn more about our Tax Preparation Services for Individuals!

CRYPTO TAX SERVICES

We know how to reconcile crypto transactions generated in Kraken, Gemini, Coinbase, Bittrex and other exchanges. We have worked with many crypto currencies such as Bitcoin, SALT, ICN, Ether, EOS, BAT, Zcash, Steem, NEO, OMG, IOTA, and many more.

If you had crypto transactions we will take care of the reconciliation of the crypto transactions and insert it into the tax return. We partner with Legible to assist with the reconciliation.

Our service Form 1040 + Schedule A + Schedule D + 8949 + Sch Ep2 + state return + FATCA & FBAR reporting.

Contact Us for more information!

Tax Consulting

As tax consultants, Kaufman Accounting does more for clients than simply prepare and file returns. We serve as your guide to tax planning and preparation, creating custom strategies for the maximum amount of credits and deductions. We get to know our clients and find them ways to save money, plan for their futures, and help them enjoy a stress-free tax season.

If you have questions about your taxes or tax situation, contact our firm for tax consulting services. We are committed to making your financial strategy work for you.

Tax Consulting with Your Goals in Mind

Your consultation appointment begins with a thorough analysis of your current financial situation. Our firm takes this time to determine the following about your standing:

By evaluating what can affect your tax return, we create a plan for filing that aligns with your financial goals. If you own a home, you may be eligible to receive credits on mortgage payments to put toward value-increasing improvements and renovations. Personal life events can affect tax strategies as well: did you have a baby or finalize a divorce this year? Ask our tax consultants how we can limit your liability and take advantage of all applicable credits for childcare, alimony, or even tuition payments.

Our job is to help you save money so you can meet your personal goals, including investing in your future, financing the cost of medical care for a loved one, or saving for a significant purchase.

Establishing Unique Filing Plans for Businesses and Individuals

Tax services from Kaufman Accounting are customized for both individual filers and business owners who need more extensive support. Part of our planning process for entrepreneurs includes strategy on how to minimize future taxes as your company grows. Our firm evaluates whether you should incorporate your business to lower tax and personal financial liability, selecting an entity such as Limited Liability Partnerships or Corporations, among others.

For individuals, your plan may consider gifting real estate in foreign countries, transferring assets via your estate, and whether to contribute money to retirement funds as a savings strategy. Let our experienced accountants find the best way to meet your tax needs.

Get Experienced Help for Your Tax Needs – Contact Us Today!

For more information on money-saving strategies as they apply to your federal and state return, contact Kaufman Accounting today to speak to a member of our team. We are here to help develop personalized solutions for your financial concerns.

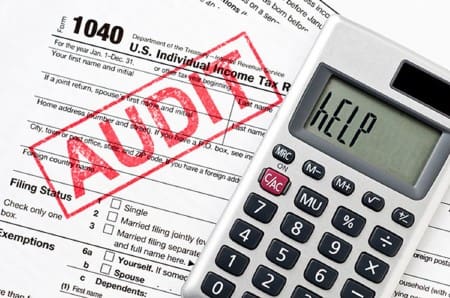

Audit Protection Plan

Kaufman Accounting can represent you in the event of an audit or if you receive a notice/letter from the IRS or state tax authority.

In light of the increased risk of audits and tax authority correspondence being sent to higher-risk individuals, many of our clients have requested that we put into place an additional layer of security. With this goal in mind, we have decided to offer an Audit Protection Plan (APP) to eligible individual clients*, providing peace of mind in case you are contacted by a tax authority.

Tax authorities send letters to taxpayers every year for various reasons including random audit selection, items missing from the tax return that preparer was not aware of (K-1s, W-2s, etc.) as well as errors that require fixing.

For a small fee of $95, we will represent you in the event of an audit or if you receive a notice/letter from the IRS or state tax authority.

The APP includes phone calls with you, with the IRS and/or with the state tax department, written correspondence, special calculations, etc.

We assume that all eligible individual clients will choose to enroll. If you decide to opt out, please let us know before the return is filed. Keep in mind that our representation will be based on an hourly fee between $200 and $350 per hour with a minimum fee of $300.

Within the statute of limitation, the IRS has 3 years to audit a tax return.

Eligible clients are individual clients with a gross income of up to $1,100,000 during the tax year and NO adjustments to their Form(s) W-2 is required.

The APP covers up to 2 hours of representation in the event of a notice/letter and up to 6 hours in the event of an audit.

The APP is for the current tax year individual tax returns. These plans are sold on an annual basis. The purchase of one plan does not include previous or future tax years.

* Eligible clients are INDIVIDUAL CLIENTS with a gross income of up to $1,100,000 during tax year and NO adjustments to their Form(s) W-2 is required.