Search Posts

Recent Posts

- February 2026- Q&A, Virtual Currency February 4, 2026

- Itemized Deductions-Interest Paid February 4, 2026

- High Income Taxpayers February 4, 2026

- Tax Time! January 6, 2026

- Capital Gains and Losses January 6, 2026

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

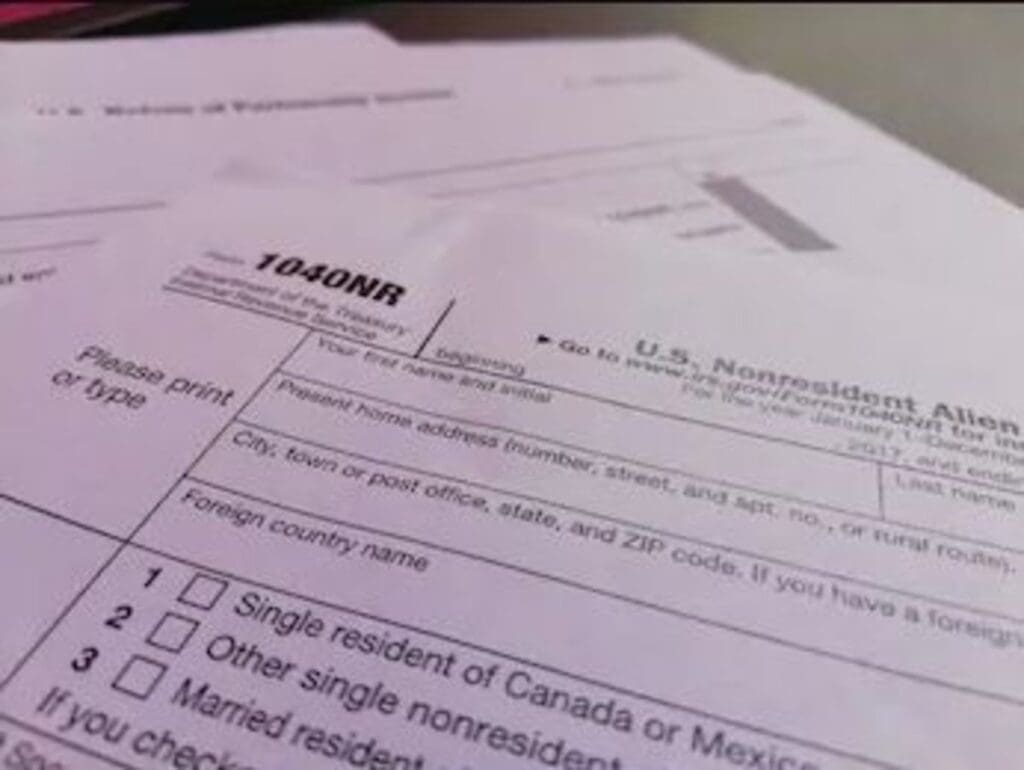

NON-RESIDENT ALIEN TAX RETURN

If you are not a citizen of the US, specific rules apply to determine if you are a resident alien or a nonresident alien for tax purposes. Before you worry whether you’re filing your taxes correctly, consider if you are required to file a nonresident alien tax return in the first place.

If any of the following apply to your specific situation, you MAY need to file a return and pay taxes in the US:

- Engaged in a trade or business in the United States

- Investment in US real estate

- Investment in a US LLC

- Withdrawal of 401K or IRA

- Received income from an entity in the US as an employee

- Net earnings from self-employment

- Received passive income from US sources

- Represented an estate or trust

Making sure you’re using the right forms and submitting information on time is an important part of avoiding complications and maximizing credits for any taxpayer — especially those with special considerations, including those with non-resident alien status.

In some cases, treaties between your country of origin and the US dictate the percentage at which you may be taxed. In other cases, you may be eligible for business credits that lower tax amounts.

Kaufman Accounting helps foreign individuals make sense of their US tax return. We work to minimize liability and maximize credits. Our goal is making sure non-resident aliens are compliant with all US tax laws that dictate how much and when they should pay the federal government. Learn more about how Kaufman Accounting can help with your non-resident tax return by contacting us today for an introductory consultation.