Search Posts

Recent Posts

- What records do I need to maintain regarding my transactions in virtual currency? June 17, 2025

- Estimated Taxes June 17, 2025

- Record Keeping Requirements for Charitable Contributions June 17, 2025

- Buying and Selling with Virtual Currency March 12, 2025

- Essential tax tips for marriage status changes March 12, 2025

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

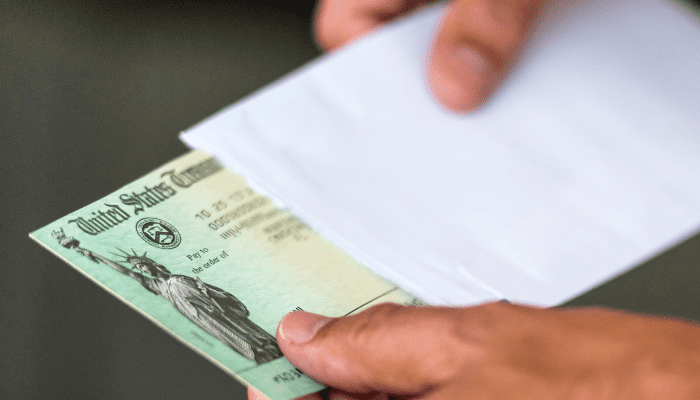

Third Round of Economic Impact Payments

With the recent approval of the American Rescue Plan Act, the third round of Economic Impact Payments (EIP3) have already reached many eligible taxpayers. Additional batches of payments will be sent in the coming weeks.

No action is needed by most taxpayers, payments will be automatic and calculated by the IRS. The IRS will use data already in its system to send the third stimulus payments and most eligible taxpayers will receive their payments via direct deposit. Taxpayers can use the IRS Get My Payment to get the latest information on their payments.

Individuals who do not receive direct deposit should watch their mail carefully for either a paper check or debit card. The Economic Impact Payment Card or EIP card, will arrive in a white envelope prominently displaying the US Department of the Treasury Seal.

In general, most eligible individuals will receive $1,400 for themselves and $1,400 for each of their qualifying dependents claimed on their tax return. The EIP3 will be based on the taxpayers most recently filed tax return from either 2020 or 2019.

The IRS reminds taxpayers that the income levels for this new round of stimulus have changed. Payments will begin to be reduced for individuals making $75,000 or above in Adjusted Gross Income ($150,000 for married filed jointly). Payments phase out entirely at $80,00 for Individuals ($160,00 for those married filing jointly). Taxpayers with incomes above these levels are not eligible for a payment.

As with the first two Economic Impact Payments, people will receive an IRS notice after they receive the payment indicating the amount of payment. This letter should be kept for your tax records.

More information on the third round of Economic Impact Payments can be found on the IRS website at: Third Economic Impact Payment