Search Posts

Recent Posts

- February 2026- Q&A, Virtual Currency February 4, 2026

- Itemized Deductions-Interest Paid February 4, 2026

- High Income Taxpayers February 4, 2026

- Tax Time! January 6, 2026

- Capital Gains and Losses January 6, 2026

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

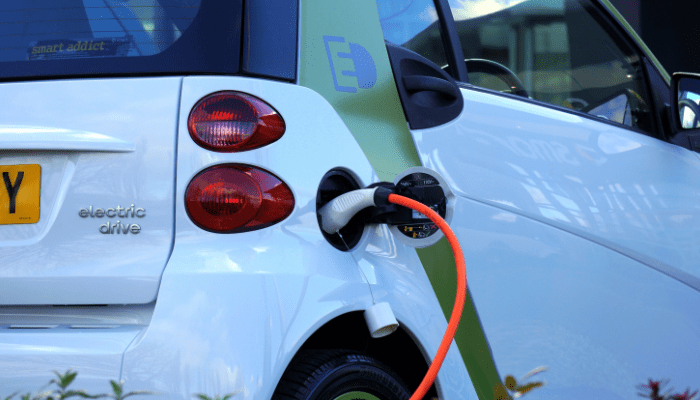

Credits for new clean vehicles purchased in 2023 or after

If you placed in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit.

At the time of sale, a seller must give you information about your vehicle’s qualifications. Sellers must also register online and report the same information to the IRS. If they don’t, your vehicle won’t be eligible for the credit.

Who qualifies

You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032.

The credit is available to individuals and their businesses.

To qualify, you must:

- Buy it for your own use, not for resale

- Use it primarily in the U.S.

In addition, your modified adjusted gross income (AGI) may not exceed:

- $300,000 for married couples filing jointly or a surviving spouse

- $225,000 for heads of households

- $150,000 for all other filers

You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less. If your modified AGI is below the threshold in 1 of the 2 years, you can claim the credit.

If you do not transfer the credit, it is nonrefundable when you file your taxes, so you can’t get back more on the credit than you owe in taxes. You can’t apply any excess credit to future tax years.

Credit amount

The amount of the credit depends on when you placed the vehicle in-service (took delivery), regardless of purchase date.

Click the button below to see if a vehicle is eligible for the new clean vehicle credit.

Go to fueleconomy.gov

How to claim the credit

To claim the credit, file Form 8936, Clean Vehicle Credits with your tax return. You will need to provide your vehicle’s VIN.

Get a time-of-sale report

The dealer should give you a paper copy of a time-of-sale report when you complete your purchase.

Keep this copy for your records because it affirms that the dealer sent a report to the IRS on the purchase date.